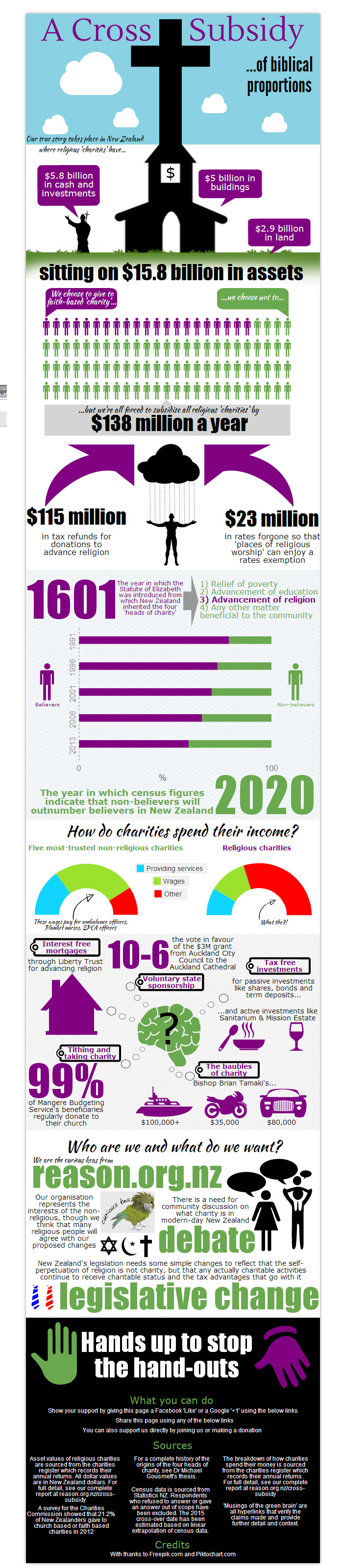

Researchers at the New Zealand Association of Rationalists and Humanists have released a report after conducting an investigation of the impact of New Zealand legislation that explicitly and deliberately gives favour to religious organisations and their donors. By doing so, this legislation creates an imbalance in the burden of paying taxes and rates. This amounts to a cross-subsidy from the 78.8% of New Zealanders who did not give money to church-based charities in 2012 to the 21.2% who did.

Our researchers estimate the annual value of the cross-subsidy to be $138 million, though this has some elements that are overstated and some that are understated. On the back of this, registered charities with some religious purpose have built up total assets of $15.8 billion.

- Regardless of the size of the cross-subsidy, there are good principled reasons why the legislation should be fair:

- it would make for a fairer country in which freedom from religion was improved without impinging anyone’s freedom of religion

- it would give New Zealanders a choice about whether to support the advancement of religion

- it would ensure that anyone choosing to support the advancement of religion can be sure they’re supporting only their chosen religion

- it could lead to some combination of higher tax revenue and increased support for charitable activities

- it is more efficient not to subsidise any belief systems because they can’t all be right (but they can all be wrong).

Our researchers have compiled a report entitled Religious financial privileges in New Zealand that details the findings of the research.