Why do religions pay few taxes? Why do companies owned by religions also avoid tax? With more non-believers than ever – is this fair? A New Documentary called ‘Pennies from Heaven’ launched today seeking to explore the controversial links between tax and religion. NZARH member Toby Ricketts, is funding a project that will call into question charity laws in New Zealand and ask the hard questions about state sponsorship of religions in NZ and around the world. Please watch the trailer and consider donating.

What’s the film about?

The essential message of this film is that solely ‘advancing religion’ should not automatically be considered a charitable purpose.

The 2013 Census has confirmed that the number of non-religious people in New Zealand continues to steadily increase (in 2013, 1.6 million people identified as non-religious) and suggests that by 2020 the non-religious will be in the majority. This is a trend that is observable not just in New Zealand but across much of the western world.

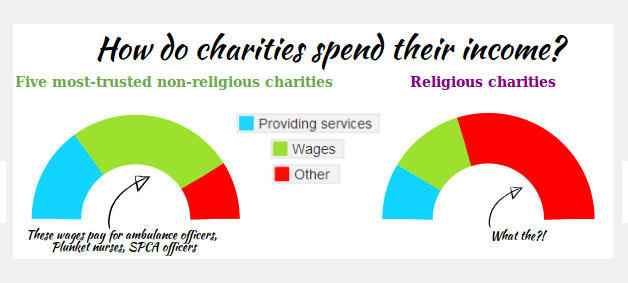

Despite this huge rise in the number of non-believers and increased focus on the importance of separation of church and state, most ‘secular’ governments continue to subsidise religious organisations; providing them with broad tax immunity (including any companies or corporations that they own), local rates exemptions and other entitlements. While the public expectation is that all religions are behaving as charities in the traditional sense (working to relieve poverty and advance the public good, etc.), the reality is that some churches are behaving more like corporations; stockpiling cash and buying external investments (putting aside for the moment the mansions, sports cars and diamond rings sported by bishops and ministers). The result of this tax break for the religious is that there is less money for education, healthcare, conservation and other core state functions that would benefit a nation as a whole.